Proprietary Information (Unofficial IRS document)

Pay Federal (IRS) Taxes

1. Go to IRS direct pay https://directpay.irs.gov/directpay/payment?execution=e1s1

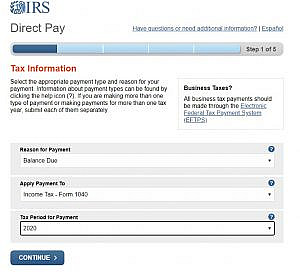

2. The following screen should appear:

3. If paying your end of year amount due on your tax return, select Reason for Payment: Balance Due, Apply Payment to: Income Tax Form 1040, Tax Period for Payment: Select year of tax return.

4. If paying quarterly estimated tax payment, select Reason for Payment: Estimated Tax, Apply Payment to: 1040ES (for 1040, 1040A, 1040EZ, Tax Period for Payment: Select year for tax payment. Please remember that Q4 payments are made after the year ends, but still applies to the preceding year (example: Q4 2020 estimated tax payment, is made in January 2021, but still select 2020 as the tax period for payment.

5. Enter the “Verify Identity” information, you will need to enter information from last year’s tax return.

6. Enter payment information.

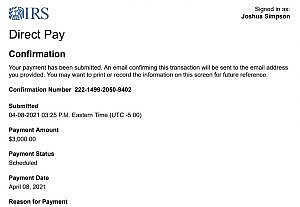

7. Save the confirmation of payment to your files and send a copy to Simpson & Simpson Accounting. The confirmation should look like this:

Pay GA taxes

- Go to website for GA department of revenue. Here is the link: https://gtc.dor.ga.gov/ It should look this:

- Click on “Make a Quick Payment” under Common Tasks

- Select “Individual” under Customer Type. “Business” is for paying C Corp taxes, so do not select if you have an LLC, multimember LLC, or S Corp

- Select “No” payment number, enter Payor Information, select “Individual Income Annual”, select the year of your Tax Return or year in which you are paying estimated tax payments.

- Enter payment information and submit, please save to your files, and send to Simpson & Simpson Accounting the payment confirmation. The payment confirmation should look something like this:

Feel free to reach out if you have any other questions!