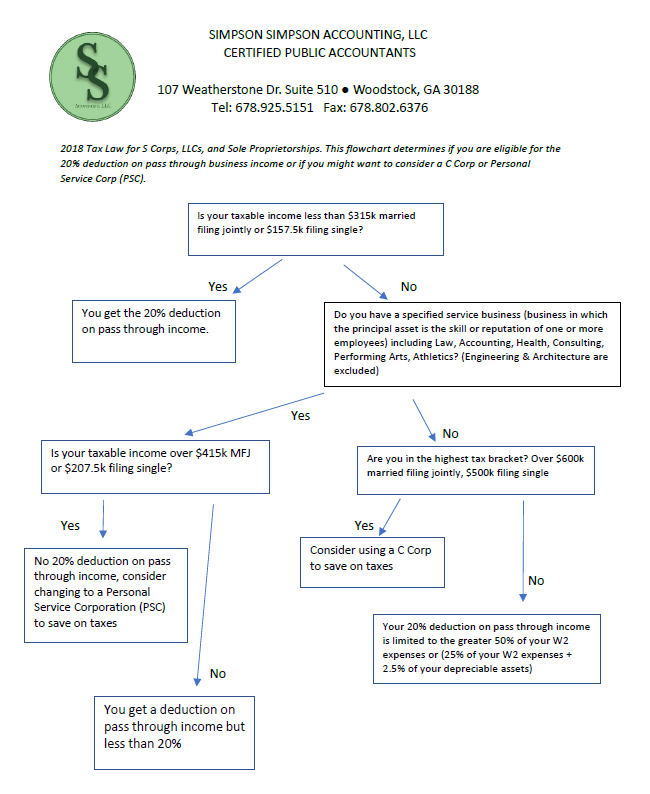

Since the 20% deduction for qualified business income is not so easy to follow, we created a flowchart to try and provide some clarity. The key word here is “try”. Kind of goes against the buzz phrase, “Your tax return will fit on the back of a post card” 🙂 As you can see, it […]

2018 Tax Law Changes Please note these changes do not apply for 2017 tax returns! Here are some but not close to all of the 2018 tax law changes: Lower individual tax brackets until 2025 nice….. (see 2018 tax bracket below) Corporate tax rate changes from 35% to 21% That is a HUGE change! Hopefully Corporate America will […]

“If my accounting software (i.e. QuickBooks Online) downloads/imports all my bank transactions straight from the bank, isn’t it a waste of time to reconcile bank accounts each month?” The more we have performed these bank reconciliations for clients, the more we realize their utmost importance. Listed below are some common issues and why it is […]

Tired of Corporate America and ready to achieve your dreams? Our CPA’s can assist in starting your business on the right path to success. Business Start-Up Package – $1,000 Setup your LLC Obtain your Federal Employer Identification Number (FEIN) Obtain S Corp. designation (If eligible) 2 hours of QuickBooks Online Setup/Training 1 hour of CPA […]

Written by Josh Simpson, CPA – 11/7/2017 -Iraq Veteran turned CPA and Owner of Simpson & Simpson Accounting- –Please let us know if you would like help with any of these areas, mission accomplished when we save you hard-earned dollars!- Preparing for your Tax returns as a Business Owner – Year Ending 12/31/17 […]

Real estate is one of the all-time favorite investments, and for good reason. I heard it best when someone said there is only so much of it and no more will be made. In comparison, companies can issue more stocks when wanted and it is not a tangible asset. I do love stocks as well, […]

The United States is one of the most generous countries in the world. You are probably saying, “Yes, I already know that”, but did you know that Myanmar is the #1 most generous country in the world? I did not, but that is not the purpose of this article. Every year, more and more non […]

I don’t know about you but I didn’t learn much about how to start a business in business school. Today social media is king – Instagram, Facebook, LinkedIn, Google, which are all great ways to promote your business, but what about the less sexy aspects of starting a business? Accounting/Legal are keystones of any successful […]

I have talked with many families who fall under the false notion that the company they work for provides them with a sufficient dollar amount of life insurance. Companies give most of their employees just enough pay, health insurance, life insurance and other benefits so that the company can get a deduction and the employee […]

I hope so! But, we will just have to wait and see. To reform the health care system is a difficult task in deed and we saw that the recent attempt failed. Many do not realize, but tax reform is even more difficult to reform than health care. I remember one of my college professors, […]