Knowing who or what companies should be sent a 1099 from your company can be very confusing. On top of that, it can be difficult to determine what type of 1099 should be sent from your company to the contractor or vendor (1099-NEC, 1099-MISC, 1099-K, 1099-INT etc.)

The most important 1099’s that need to be sent and watched closest by the IRS are the 1099-NEC. The term NEC stands for non-employee compensation. Examples of who would need to be sent a 1099-NEC would be an independent contractor who is a software engineer and performs coding for the company for a short period, an independent construction worker who completes a short-term construction job, such as the electric wiring of a house that will be sold by a company that the builder owns, or an independent contractor who helps an accounting firm prepare tax returns for clients during tax season.

The reason why 1099-NECs are closely watched by the IRS is that many companies show large deductions for contractor’s expenses on their business tax return (S Corp return, Partnership Return, C Corp return) or business schedule C of their personal tax returns. For example, if a company deducts $100,000 in contractor’s expenses on their 2022 S Corp tax return, the IRS wants to make sure that all 1099-NEC’s that were sent to the independent contractor add up to $100,000.

The whole reason behind this, is the IRS wants to make sure everyone pays taxes on the income they earn. Even though the contractor’s expense it is a deduction to Company sending 1099-NECs, it is income to the independent contractor.

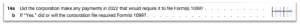

One of the most important questions to answer on the S Corp tax return is this question, below, directly from the 1120S:

If a Company files an S Corp tax return, has contractor’s expense on the S Corp tax return, and marks they did not file any 1099’s, this is a serious red flag. The consequence could be paying taxes for the amount of the contractor’s expense claimed.

We had a client that shared a story about this exact case (For the record, this was before he became a client). He had approximately $40,000 of contractor’s expenses on his business schedule C of his 2020 personal tax return. The IRS checked his account and verified that no 1099’s were sent to his independent contractors for 2020. The IRS asked him how he was paying his contractors, being from another country and not yet familiar with US tax law, he said he paid his contractors in cash. The IRS then questioned, “How will your independent contractors pay their taxes owed?” The client answered that he was not sure. “Well then”, said the IRS. “You will have to pay their taxes.”

A Major Change to IRS Rules Regarding Cash App Payments:

If your payments were made to the independent contractor through an electronic payment facilitator like Cash App, Paypal, Venmo, Zelle, etc. you do not need to file/send a 1099-NEC to that independent contractor. Starting in 2022, these electronic payment facilitators will send 1099-Ks to contractors who received over $600 in 2022.

Now is the time to make sure that you as the business owner have all the new 2022 W-9s from your contractors and any changes that need to be made to the W-9s for your existing contractors. The deadline for filing/sending 2022 1099-NECs to independent contractors is 1/31/2023. Be sure to check for address changes from those contractors before they are filed/mailed.

Don’t put off this important task of preparing/filing 2022 1099’s. It is a closely watched area by the IRS.

Simpson & Simpson Accounting can help prepare, file with the IRS, and send out all the 1099-NECs to the independent contractors of your business. Call us for a free 30-minute consultation to discuss the accounting/tax/IRS situation of your business and we can provide the solutions you have been looking for. We would love to help your business in the new year!